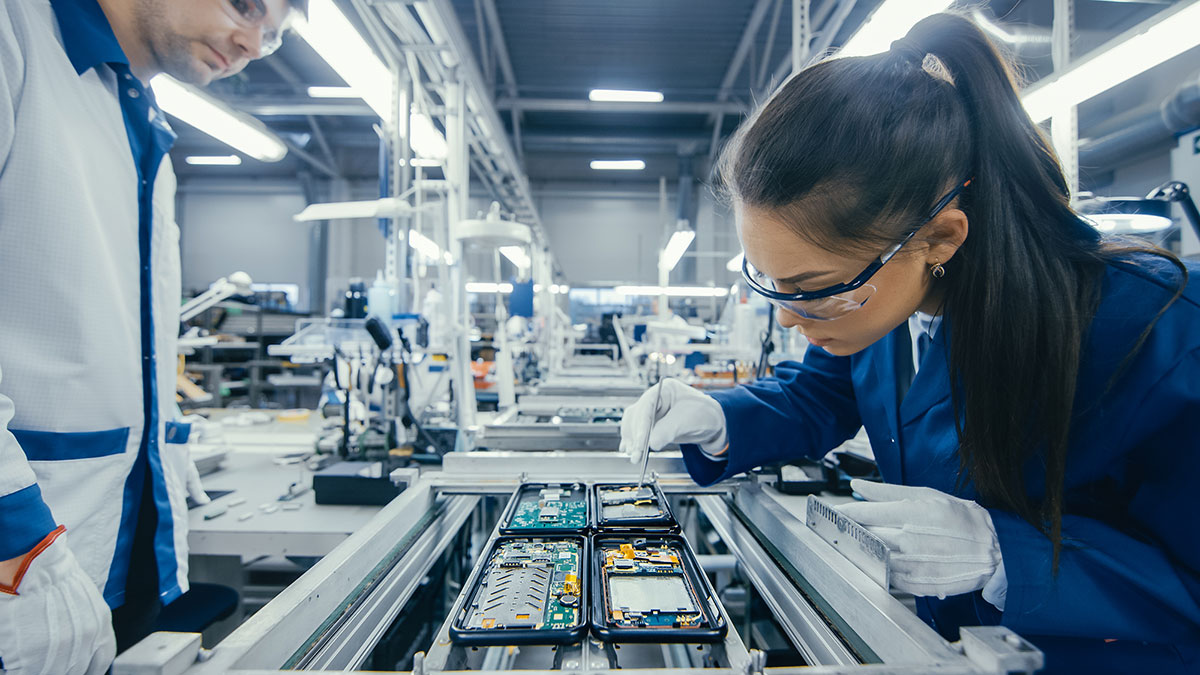

For those leading global supply chains end to end, 2020 to 2022 was a period marked by supply chain issues and levels of consumer demand that were unprecedented. Against that backdrop, a nationwide shortage of talent increased the pressure on already-overburdened plants and manufacturing facilities, as well as their supply chains.

Externally, we are hearing the talent issue should have abated by the end of the first quarter of 2023. With supply chain issues easing and many consumers looking to cut spending in an uncertain environment, the demand side of the equation all points to extra breathing room for existing plant associates and managers—a factor that may reduce the need to bring on additional hires.

On the talent supply side, however, unemployment remained at 3.6% or less throughout the entire quarter—an indication that, even with well-publicized layoffs in sectors such as tech, the talent market may not have eased.

Feedback from 27 Supply Chain Officers at Scale?

Taken together, these facts beg the question of how the Supply Chain function is faring when it comes to meeting its need for talent at present—and where it is likely headed for the remainder of the year. Throughout the first quarter, Carpe Diem spoke to more than 27 Chief Supply Chain Officers from the world’s largest and most admired companies for Supply Chain Excellence to find out whether the crisis-level conditions seen in the past two years had abated within their manufacturing and supply chains, and how those affected by shortages have been tackling the issue.

The Talent Crisis is Over…Right?

For many of the leaders surveyed, the staffing crisis is quickly becoming a thing of the past—albeit one that isn’t completely over yet. Several leaders offered comments to the effect that shortages “are not chronic anymore”, with other issues—including supply chain disruption and demand shortage—occupying their thoughts.

However, a significant number of leaders noted that shortages differed by location—the Upper Midwest being an ongoing pain point for many. Additionally, shortages persist for skilled and experienced hires, with engineering and supervisory positions still extremely difficult to fill—a situation that creates difficulties across the entire supply chain.

Supply Chain Talent Mitigation Strategies

Perhaps unsurprisingly, many of the leaders who noted that their 2023 talent outlook was more positive also had the most to offer in terms of the mitigation strategies they had put into place.

Training: One leader noted that their company “started supervisor programs – [our] most difficult to hire [positions]”—a direct outgrowth of the tight labor market combined with an aging workforce where older, experienced employees are retiring and leaving a knowledge and skills gap in their wake.

Widening the talent pool: “[Our company is] hiring college grads from Mexico, and bringing them to the US,” noted one leader—an approach that is helping the company to meet demand while also hastening a company-wide focus on DEI initiatives.

Streamlining work processes: In a bid to improve output and portability of employees, one leader noted that their company has “designed and deployed a common operating model across all facilities.” That process, which included setting a “clear set of objectives aligned with all the locations,” and “reorganizing and repurposing for the new strategy and transformation” has led to sites responding faster. Additionally, the company has implemented an automated replication management system to collect and disseminate best practices—an initiative that will help previous gains to snowball.

Automating workflows: In areas where automation is possible, leaders have been looking to leverage it to cope with the shortage. One leader at a PPE production company noted that a significant increase in capital expenditure was already paying dividends, with a single operator able to harness technology to produce the same output that had previously been conducted by over 20 full-time employees.

Overall, while labor shortages in the world’s largest and most complex supply chains may be easing, the strategies adopted by some of the most successful leaders in the field are worth considering to ensure that plants can continue to meet demand under any circumstance. With the younger members of the Baby Boomer generation set to hit retirement age by 2030, the economy is facing a significant loss of knowledge and talent over the remainder of the decade—something that leaders would be wise to plan for, even if the immediate future looks less like a crisis than the immediate past.

Jeff DeFazio

These market insights from Carpe Diem Global Partners are gathered from the firm’s extensive client work leading Board, CEO, CXO, and CHRO executive search engagements for public and private multinational companies. For deeper, custom insights, contact Jeff DeFazio at Jdefazio@carpediempartners.com and Micheal Whitehead at Mwhitehead@carpediempartners.com.

Michael Whitehead